“Before, we had to use 10-15 plug-ins just to get the features we needed.”

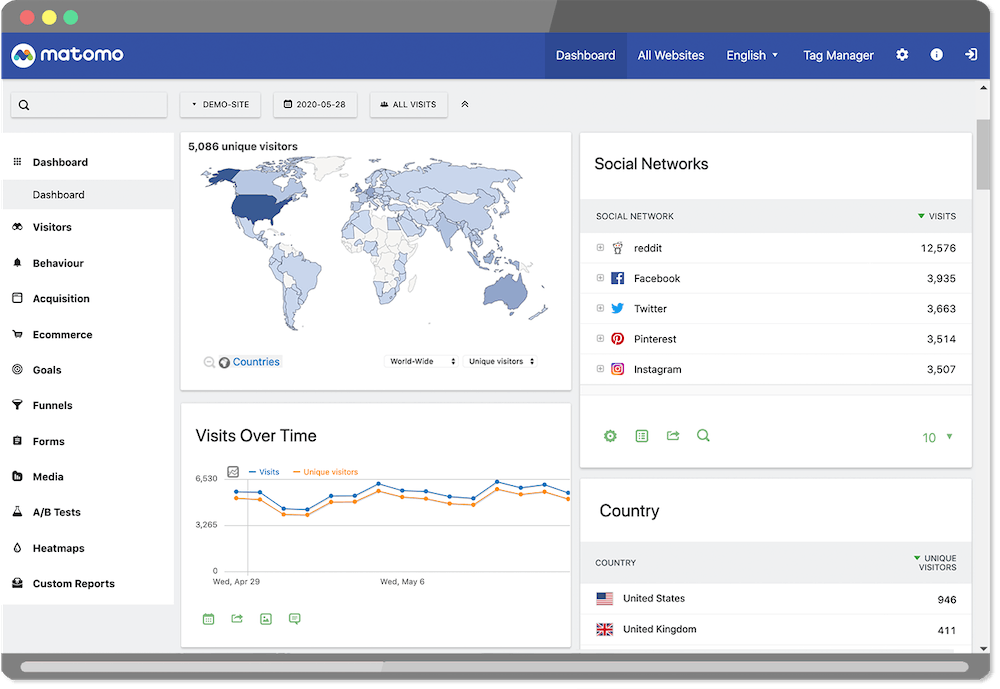

Matomo is an all-in-one web analytics platform that lets its customers effectively measure success while keeping 100% ownership of their data. On launching in 2016, the company built their tech stack on an open source ecommerce platform. While this solution served its purpose, Lead developer and Innocraft Co-Founder Thomas Steur knew that these billing processes could be more efficient, he explains:

“To get the features we needed, we had to use 10-15 plug-ins. This meant at least one or two updates every week as well as the extra time to go through and address any problems or bugs that came up.

“While it was good to have the control to be able to go in and fix things in the open source modules, it meant spending 3 to 4 hours a week just to keep everything secure and running.”

As Matomo started to look at serving more customers globally, the team faced new challenges including allowing customers in new markets to pay using their preferred payment method. Despite integrating with other payment service providers, they were still limited to Visa and Mastercard, in only 2 currencies:

“As a New Zealand business, it’s difficult to accept payments globally. We needed to be able to accept local currencies and payments from local cards but with our previous setup, it just wasn’t possible.”

On selling in more countries, the burden of managing payment security and tax compliance in multiple markets also became clear.

“If we thought about being tax compliant in every country, that would be a lot of work that you just can’t do as a startup.”

Matomo also experienced a card verification attack, which saw more than 55,000 card checks running through the site. This was flagged by Matomo’s previous provider and resulted in their account being temporarily suspended:

“Our account was suspended for two days, during which we couldn’t take any payments. Each check cost us as well. The whole incident cost us $25,000. We knew we needed to find another solution.”

“The technical support from Paddle was really helpful.”

Matomo made the decision to move away from their existing provider and partner with Paddle, which would allow the team to manage everything in one unified platform. Thomas says:

“What I really liked about Paddle was the user experience and the fact that it would free up my time on the maintenance side of things.”

On migrating to Paddle, Thomas was aware of how important it was to make sure the data was handled correctly, to avoid any issues for Matomo customers. He says:

“It’s a scary thing to migrate from one platform to another and making sure all of the data has been copied correctly but the technical support from Paddle was really helpful."

“Once the migration was complete, we were able to work with Paddle to implement modifiers to handle one time charges and overage fees into our billing flow.”

The move also gave Matomo access to Paddle’s global payments infrastructure, helping them to serve more customers globally:

“With Paddle we can support a lot more currencies and credit cards. We now accept payments in 12 currencies when before we could support just 2. For us, this is where Paddle brings a big advantage, especially for New Zealand businesses.”

“I don’t have to spend time fixing issues in Paddle. It just works”

Since using Paddle, Thomas has been able to get back the time he was previously spending updating and maintaining the plug-ins:

“I don’t have to spend time fixing issues in Paddle, It just works. This gives me back at least 3-4 hours a week which I can then spend on developing our product.”

Using Paddle as Merchant of Record also means that Matomo avoids using internal resources on managing global tax compliance and the risk associated with global payments.

“Paddle takes on that risk for us so we don’t have to worry about any more issues with card verification attacks or local compliance legislation – even though we are accepting payments in an additional 10 currencies.”

With time back to focus on the product, Matomo has also optimized the way it manages customers moving between paid plans.

“Before this process was incredibly painful and difficult. Now, it’s a nice pop-up with our branded interface and we just do an API call in the background to upgrade the user.”

Looking forward, Matomo is looking to optimize and automate the way customers move between business and enterprise plans. Thomas explains:

“We’re looking to automate this process, so people can choose how many more seats or websites they want to add to a plan, without going through our support team. This is something we couldn’t have even considered with our old platform, so it’s great to be able to customize in this way with Paddle.”