Understanding your revenue is crucial to the health of your business. Learn how the sales revenue formula helps you calculate revenue to optimize your price strategy, plan expenses, determine growth strategies, and analyze trends.

Before we get to the formula for calculating revenue, let's make another revenue formula very clear:

Understanding revenue = understanding your business = growing your business

Revenue is the most fundamental metric for any company, and yet it is seldom understood perfectly. First, there is more than one type of revenue. Second, recording it and calculating it get progressively more complex as your business scales. And third, after you've calculated it, you must know what to do with it.

The future of your business starts with one simple equation.

What is revenue?

Revenue (sometimes referred to as sales revenue) is the amount of gross income produced through sales of products or services. A simple way to solve for revenue is by multiplying the number of sales and the sales price or average service price (Revenue = Sales x Average Price of Service or Sales Price).

With that being said, not all revenues are equal. Literally. Being able to differentiate between the different types of revenue is vital for proper accounting and reporting.

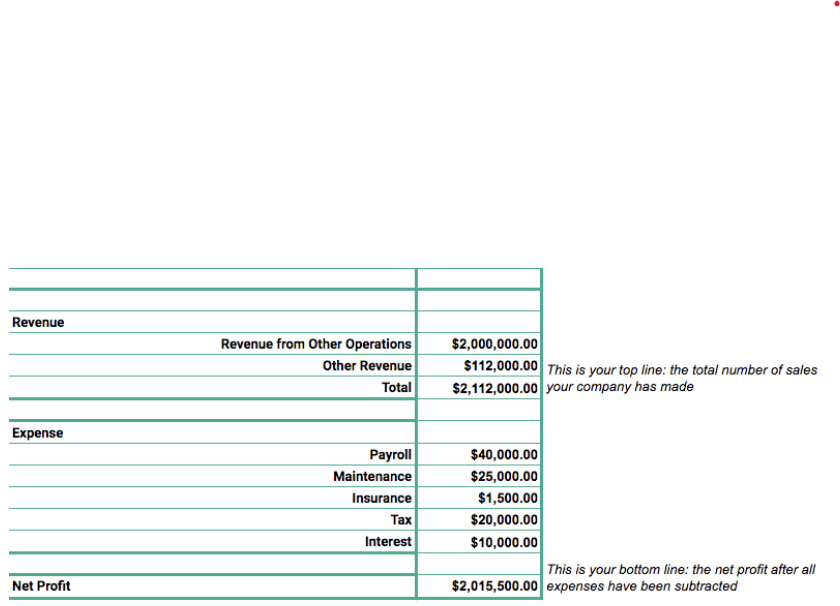

What is total revenue?

Total revenue is all income generated from the total sales of goods and services regardless of revenue source: sales, marketing, customer success, and investments. Total revenue is almost always higher than sales revenue because it is the cumulation of all revenue generating channels of a company. As such, the calculation for total revenue is slightly different.

The total revenue formula

Total revenue is important because it gives businesses a high-level understanding of the relationship between pricing and consumer demand for an additional unit of product at any given time.

The total revenue formula is simply:

Price * quantity sold = total revenue

What is sales revenue?

Sales revenue is income generated exclusively from the total sales of goods or services by a company. This excludes income generated by any other revenue stream which is not sales, like interest on cash in the bank. As such, sales revenue is a subset of total revenue. In other words, all sales are revenue but not all revenue is sales.

Sales revenue formula: How to calculate sales revenue?

The sales revenue formula calculates revenue by multiplying the number of units sold by the average unit price. Service-based businesses calculate the formula slightly differently: by multiplying the number of customers by the average service price.

Now, let's take a look at the revenue formula itself (in both forms):

For product-based businesses

Revenue = Number of units sold x average price

For service-based companies

Revenue = Number of customers x average price of services

A sales-revenue example

Last year we sold 1,000 game consoles for $350 per piece.

Sales revenue = 1,000 x 350 = $350,000

Potential pitfalls of using the sales revenue formula

It seems so simple, but incorrectly calculating revenue has hurt many companies. Keeping track of revenue manually (e.g., using excel spreadsheet formulas or inputting the values by hand) can cause untold problems:

- Tracking revenue manually can quickly grow out of control. You must work out when you are entitled to payment for every subscription. Do you take it on billing? Do you take it incrementally over the course of a month of payment? Do you charge per unit of use?

- Every revenue-affecting change in your business needs to be accounted for. For example, if you alter a pricing page, underlying spreadsheets will have to be changed to account for this. Discounts, refunds, new pricing, additional revenue, and enterprise tiers can all complicate the amount of data that needs to be reconciled at the end of the year.

If you're a subscription business, revenue can be even more difficult to calculate. Now it's time for another round of “vs.”

Net revenue vs. gross revenue

The fact is, not all revenues are equal. Literally. Being able to differentiate between the different types of revenue is vital for accounting, particularly with respect to net and gross revenue.

Misconceptions about net and gross revenue can significantly affect a company's income tax. Therefore, it's important to be able to distinguish between the two:

- Gross revenue concerns all income from a sale, with no consideration for any expenditures from any source. If a retailer sells the latest in a new line of sneakers for $100, the gross revenue would be $100.

- Net revenue subtracts the cost of goods sold from gross revenue. Fees for production, shipping, and storage, as well as any discounts, allowances, and returns, can all potentially contribute toward this cost. Net revenue from an item worth $100 that costs $25 to make would be $75.

Recognized revenue vs. deferred revenue

Recognized revenue is simple; it is recorded as soon as the business transaction is conducted. Once the sale has been completed, you can record it — all of it — in your financial statements.

A subscription-based company regularly receives payment for goods or services that they deliver in the future. As the company has received money in advance of earning it, this is known as deferred revenue. Therefore, this must be recorded not as actual income but as a current liability.

Let's say a company offers a video subscription service for $8.99 a month, totaling $107.88 per year. On receipt of a yearly subscription purchase from a new customer, the company cannot simply record the entire year's subscription. Each monthly payment is recorded as it is delivered to the company, before being reversed and booked as revenue at the end-of-year cycle.

Cash flow is not revenue, and treating them as the same thing could be fatal for your business. Bear the difference in mind when calculating and recording your revenue.