Talking about the different pricing methods, for me, is equivalent to a kid in a candy store. Of course, like a candy store, there are many product pricing options but you can’t use them all. We of course have our favorite pricing methods here at ProfitWell, but it’s good to understand the differences, good or bad. There are a few factors to consider when pricing your product, from your current product value and market share, to the nature of your target audience.This article will break down four common product pricing methods, along with the pros and cons of each, and best practices for implementing a strategy within your SaaS company.

4 common product pricing methods

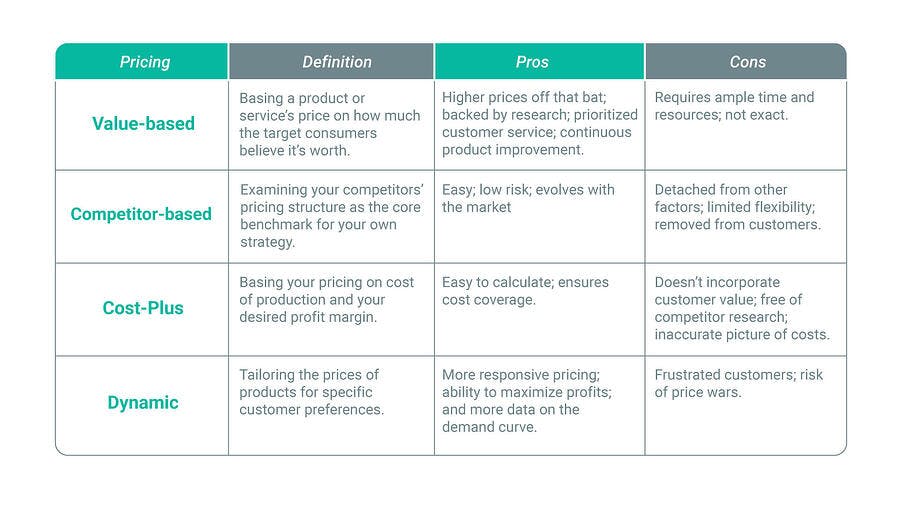

There are dozens of product pricing methods but some of the most common pricing strategies you should know and consider include:

- Value-based pricing

- Competitor-based pricing

- Cost-plus pricing

- Dynamic pricing

1. Value-based pricing

Value-based pricing is basing a product or service’s price on how much the target consumers believe it is worth. Rather than looking at your company inwardly or laterally toward competitors, value-based pricing provides an outward look.

Value-based pricing is the best option for every company that has the time and resources to execute it well. If you’re in SaaS, value-based pricing is likely a great option. Pricing is the exchange rate on the value you provide, and value-based pricing is the only strategy that puts this sentiment into action.

Pros of value-based pricing

Higher prices off the bat: You can set high prices from the get-go because you have the willingness to pay data to back it up. Remember, willingness to pay is the maximum amount a customer is willing to pay for your product or service. Then, as you continually add value to your product and create additional features, you can adjust product pricing accordingly.

Backed by research: Since value-based pricing is backed by product research, it provides real data that undoubtedly forces into a profit-generating price.

Continuous product improvement: Implementing a value-based pricing strategy means looking at your company from a customer perspective. In doing so, you’ll develop higher-quality products because you’ll gain a deeper understanding of what potential customers want from your product. You can use your customer perspective and their perceived value of your product to continually improve and add features to your product when necessary.

Prioritized customer service: Customer service takes center stage with this strategy. All customers want to feel as if their voices and concerns are accounted for. Especially since subscriptions are all about relationships, you want customers to feel nurtured by your company. Since you’re closely conducting research based on your customers, you’ll grow more attentive to their needs—building trust and strengthening retention.

Cons of value-based pricing

Requires ample time and resources: Developing a value-based strategy is not simple, in all honesty. It requires research, which is time consuming. You’ll also need to pull as many resources as you can to conduct this research.

Not exact: Value-based pricing isn’t a calculation that leads you to a hard number. It’s an approximation.

How to calculate

Determining your best value-based pricing strategy requires lots of qualitative and quantitative data. Here’s what needs to be done:

1. Identify and analyze buyer personas: Think about who you envision purchasing your product and channel them. Define your buyer personas by thinking about their personal backgrounds, role in the company, daily challenges, expectations from leadership, etc.

2. Survey and talk to your customer base: Collect customer data by surveying customers on how much they would be willing to pay for your product and which features they value most. Buyer personas come into play here because you want to survey a specific target audience, or the results won’t mean much.

3. Analyze data to build tiers and bundle packages: Use the data collected to analyze the patterns, features, benefits, and price points among your various buyer personas. Use the results to build pricing tiers.

4.Test and review: Don’t blindly implement this strategy. Test it out before releasing to work out any kinks.

Take Wistia for example

With the help of Price Intelligently, Wistia has nearly doubled the number of new sales coming in because of its kickass product pricing strategy.

As you can see, Wistia has clearly defined pricing tiers catered to different personas. If you look at the first option, it’s free. The tier clearly states what’s available with this option. Then, as your company expands, you can upgrade to the next tier for a clearly defined price. Customers know exactly what they are paying for and the value provided.

2. Competitor-based pricing

Competitor-based pricing is a strategy that looks at your competitors’ pricing structure as the core benchmark for building your own strategy. It involves looking at market trends and aligning your product pricing accordingly.

Pros of competitor-based pricing

Easy: Competitor-based pricing is not a laborious pricing strategy. It does require researching your competitors and determining the average price. But, you don’t have to survey or research customers—it’s strictly competition-focused.

Low risk: Since your prices will be similar to your competitors, customers won’t be thrown off guard. There is low risk involved with this product pricing strategy.

Evolves with the market: It has the ability to evolve with the market since you can simply change your prices as you notice the market changing around you.

Cons of competitor-based pricing

Detached from other factors: Since this strategy is based off of your competitors, it removes other factors from the equation. You don’t have willingness-to-pay data or research on your customers. It certainly doesn’t look at things like demand or value of your product.

Limited flexibility: You’re relying on your competitors to do all the heavy lifting in terms of price determination. This can be a hindrance because what if your competitors don’t have accurate product pricing research? You’re limiting your pricing to the knowledge of your competitors.

Removed from customers:

You aren’t consulting with customers. You may not realize it, but their willingness to pay could be an entirely different number than what your product is priced at. You are also detached from their needs.

How to calculate

- Identify competitors in the market Look at companies like you. Who’s selling similar products or services? You should be conducting this research regardless because it’s also good to know and understand who your competition is.

- Research their product pricing and positioning strategies: Once you narrow down the list of competitors, dig into their pricing and positioning strategies to build a map of current trends.

- Average the price of all competitors: Creating a product pricing map will help you understand what your competitors are doing individually. Calculate the average price of your product type across competitors. This will be your benchmark price.

- Choose higher, lower, or matched prices: You’ll then determine where your product or service fits into the market in order to offer smart competitive pricing tiers.

Example of competitor-based pricing

You don’t come by competitor-based pricing too often in SaaS. When you think competitor-based pricing, think big company chains like Walmart, Target, Best Buy, etc. You can find the same items for similar prices at these stores. For example, a 65” flatscreen at WalMart costs $478. But, if you price shop you’ll find that the same flatscreen costs $479.99 at both Best Buy and Target.

3. Cost-plus pricing

Cost-plus pricing bases your product pricing strategy on the cost of production and your desired profit margin. This pricing strategy is extremely simple. All it entails is taking the costs that go into developing a product then adding a percentage on top for your profit margin.

Pros of cost-plus pricing

Easy to calculate: Cost-plus pricing is by far the easiest product pricing strategy to calculate. It only involves two variables and requires no research at all.

Ensures cost coverage: Since the equation accounts for money spent on actually developing the product, your product pricing ensures that all your costs are covered. With cost-plus pricing, you’ll never be spending more than you make on the product. Overall, this product pricing strategy requires minimal resources to execute, demands little market research, but provides full coverage of your total cost and a consistent rate of return.

Cons of cost-plus pricing

Doesn’t incorporate customer value: Cost-plus pricing does not consider your customers, which isn’t ideal in SaaS. Since subscriptions are all about building strong relationships with your customers, you want a product pricing strategy that recognizes them.

Free of competitor research: You are also unaware of how competitors are pricing similar products. Since this strategy requires no research, you don’t have insights into other factors that are important.

Inaccurate picture of costs: This product pricing strategy generates an inexact picture of your costs and creates a random margin that has nothing to do with factors like customer willingness to pay or market demand.

How to calculate

Cost-plus pricing only accounts for the cost of your product and desired profit margin. Here’s the equation:

Cost + profit margin = price

For example, if it cost you $10 to make your product and you want to earn 50% of that, the equation would look like this:

10 + 50% = $15

Then, you would make $15 off that product.

Example of cost-plus pricing

Although cost-plus pricing isn’t always the best product pricing strategy in SaaS, it does work for, and is commonly seen in businesses like gas stations or grocery stores. Of course, gas stations will often take market demand into consideration, which explains that spike in gas prices sometimes.

4. Dynamic pricing

Dynamic pricing means tailoring the prices of goods or services for specific customer preferences. It’s technically the same definition as “price discrimination,” which is an illegal practice with roots embedded in the Robinson-Patman Act of 1936. You can read more about ethics and pricing here. Since the Robinson-Patman Act is riddled with holes, there are grey areas, meaning you still see companies using price discrimination all the time without penalty. Typically, dynamic pricing takes place in two forms:

1. Based on groups: Companies will use machine learning algorithms to offer different product prices to different groups. The groups are determined based on demographics, location, etc.

2. Based on time: Commonly seen in car lots. Prices will go down at the end of a month because salespeople are eager to meet their monthly quotas.

Pros of dynamic pricing

More responsive pricing: Dynamic pricing must follow certain trends, making for a naturally responsive product pricing strategy. Sometimes it means setting low prices to keep up with market trends, internal stock levels, and/or competitor data.

Ability to maximize profits: Since dynamic pricing can drive prices in both directions, businesses can increase the prices to capitalize on demand but may also lower prices with the intention of increasing sales.

More data on the demand curve: Since you’re constantly adjusting prices according to demand, dynamic pricing provides consistent data on the demand curve.

Cons of dynamic pricing

Frustrated customers: Customers may grow wary of frequent product pricing changes. The price inconsistency may confuse customers about the quality of your product and brand.

Risk of price wars: Adjusting prices to compete with similar companies could become potentially risky in terms of a price war. Your competition may also be watching your prices and continue to change theirs, leading to an unintentional price war.

How to calculate

The only effective way to implement dynamic pricing is by constantly and accurately studying demographics and market conditions. Here are some steps you can follow:

1. Quantify buyer personas

2. Ensure you’re using a value metric (what you’re physically charging for)

3. Utilize time in an auction pricing model, meaning, make sure your prices go up or down based on time

4. Couponing and discounts (Please note, we aren’t typically fans of discounting here at ProfitWell, but they can be helpful if used discreetly in a dynamic pricing strategy).

Example of dynamic pricing

Dynamic pricing relies on supply and demand, meaning it’s mostly used in transportation and hospitality industries. If you think about airlines, they typically surge prices during popular times of travel and to popular destinations. The months of March and April are typically more expensive to fly to Florida or warmer states, because spring breakers are eager to vacation. Or, consider ride sharing apps like Uber. They sometimes get away with doubling prices during high volume traffic times.

5 important metrics that should inform your product pricing

Deciding on a product pricing strategy should not be done at random. There are certain variables and metrics you should take into consideration to determine which product pricing strategy to use. You need to assess hard numbers as well as your customers' needs in order to get the most out of your pricing. Let’s go through what variables should be top of mind.

1. Fixed costs

Fixed costs are sometimes also referred to as overhead costs. These are expenses that don’t usually change from month to month. This would include things like your office space rent or your employees’ salaries. Sometimes rent will go up or people will receive a salary raise, regardless, you must account for these expenses every month. You want to make sure your products are priced to cover these recurring expenses.

2. Variable costs

You must also consider things like variable costs. A variable cost is a cost that changes in relation to variations in activity. For instance, if you’re building a physical product, a variable cost would be the direct materials you need to develop that product. More applicable for SaaS would be a variable cost such as marketing. You may strategize a new marketing sprint that requires extra spending. If that’s the case, you want to change your product pricing accordingly to cover those costs.

3. Consumer surplus

Consumer surplus is the difference between the price that consumers are willing to pay versus what they actually pay. This begs the question, “How much money (if any) is the customer leaving on the table?” Sometimes, customers pay less money than they actually are willing to pay, so when calculating your prices, ensure they level up with customer willingness-to-pay data.

4. Market demand

Your product pricing should also reflect market demand. Are you selling a product or service that’s highly coveted right now? Or maybe there’s a dip in demand and you’re not seeing as much traction. Be sure to always be watching market trends so you can price your products wisely.

5. Cost of goods sold (COGS)

Typically, I write about CAC, or customer acquisition costs. But in this case, we’re talking COGS, cost of goods sold. Looking at COGS assesses how much you are spending on inventory. This, again, is likely more applicable for physical products because you spend a certain amount to keep stock rooms, stocked. Even still, for SaaS, you can calculate how much it costs to develop a product and/or keep it in the cloud.

Critical considerations to make when pricing your products

Pricing is not one size fits all. Your company is unique and your product pricing should capitalize off of the unique value you provide. Let’s go through some critical considerations you need to be making before you set prices live.

Consider combining multiple product pricing methods

There are lots of product pricing methods, even more than the four we broke down in the paragraphs above. If your research and situation calls for it, why not combine some of the methods. Depending on the products you sell, your company may need to take advantage of different product pricing methods. For example, if you are a subscription coffee service, you may have one set value-based pricing strategy for your monthly subscription coffee. You may also sell merchandise online though, like t-shirts and beanies. If you have products in addition to the subscription, you can employ the cost-plus pricing strategy.

Ensure your product pricing accounts for costs

You absolutely need to make sure you are earning more than you are spending. Calculating costs across the board should be your first priority, then the rest of your product pricing strategy can follow.

Aim your product pricing at your target audience

Who’s your demographic? This is where buyer personas really come into play. You don’t price products higher than your target audience can afford. When you create buyer personas, you can estimate how much money customers can afford to spend on your products.

Make your product pricing reflect demand

You need to be a watchdog when it comes to market demand. Your product pricing should reflect the current demand in order to stay relevant and remain active.

Test & re-evaluate your product pricing

Don’t just settle for one method—try out multiple product pricing methods and see what works. Additionally, once you’ve conducted the research and initial implementation, try again. Maybe the first round of prices you came up with are good, but if you try again, they could be even better. Test your product pricing and re-evaluate. Even once you determine a strategy and prices that align with your product value, don’t settle on those prices for years to come. Pricing should always be on the back of your mind and something you re-evaluate every six months.

Product pricing FAQs

What is product pricing?

Product pricing is a process that entails the translation of product value into quantitative terms. Pricing decision is usually made before its initial release to the market, however, businesses can change the selling price at any point for a variety of reasons.

What is captive pricing?

Captive pricing refers to the pricing of products that are accompanied by a number of "accessory products". Although it is more common among businesses that sell a physical product, it is growing in popularity among eCommerce and SaaS companies, as well.

How to determine product pricing?

To determine product pricing, keep in mind the following metrics and factors:

- total fixed costs

- variable costs and semi-variable costs

- target audience and their willingness to pay

- market trends

- seasonal trends

- competitor's prices