Product-market fit isn't everything in SaaS. In his SaaSFest talk, Brian Balfour explains how market, product, channel, and model all need to fit together.

You're too focused on product-market fit.

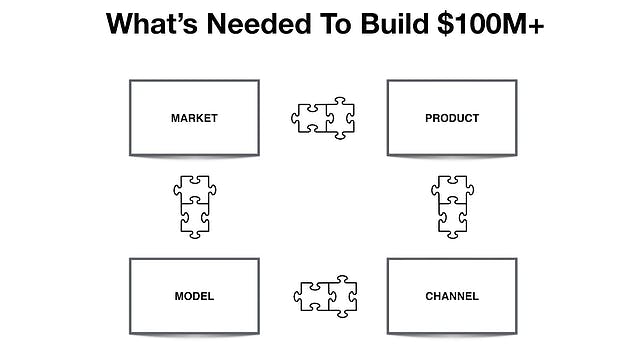

You can't grow a successful company without product-market fit. Yet, Brian Balfour, the CEO of Reforge and all around growth strategist, thinks that the SaaS industry has developed tunnel vision and become too focused on product-market fit at the expense of the bigger business ecosystem. You're forgetting about other important SaaS components that all have to fit together like jigsaw pieces for your whole business to work.

In his talk at SaaSFest, Brian explains that market, product, channel, and model all have to interact and work together as part of one constant ecosystem. As one piece changes, all of the other pieces must change with them. Rethinking how changing components fit together will help you evolve along with the dynamic SaaS industry.

Skip to...

1. Rethink the Sequence of How You Determine “Market-Product” Fit

THINK: Build your product to fit your market.

Product-market fit is not something that early-stage companies check off and then stop thinking about. As Marc Andreessen said, you have to be in a good market with a product that can satisfy that market. The market is constantly evolving, and your product should be constantly evolving to reflect that.

It's much easier to evolve with the market if your product is shaped to fit the market. That's why you'll achieve much better fit between these two components if you think market first, product second.

Brian ran into a market-product fit problem when he was building one of his first venture-backed products, Viximo. His company started by building the product, a virtual goods platform, and then intending to sell it to games, social networks, dating sites, et cetera.

This product first, market second mentality meant that they had a solution, and then they were searching for the problem. This made it much, much more difficult to identify the market that really needed a solution and was willing to pay for the product.

Instead of thinking about product-market fit, look for market-product fit. This isn't just a semantic change. If you start with the market, you start with the problem. By creating the product in response, you mirror the solution to the problem. Then you have a market and a product that actually need one another.

How You Can Develop a Market-First, Product-Second Mentality

Building a product to satisfy a market's problem starts with communicating with your potential customers. If you already have an established customer base, survey your customers about what problems still exist in their workflow and build your tools around their answers.

Crazy Egg and Kissmetrics founder Hiten Shah also recommended in his SaaSFest 2016 talk that you should learn from the problems expressed by your competition's customers. This helps you better understand your market's problems. It's especially useful if your company doesn't have an established customer base yet.

2. Rethink How Product and Acquisition Channels Fit Together

THINK: Build your product to fit the right channel.

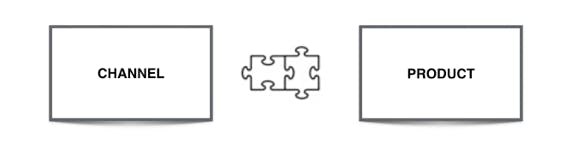

Products are built to take advantage of specific acquisition channels. If you think of product and channel as siloed in completely different stages of company development, you'll end up trying to push a product through a channel that can't support its distribution. The wrong acquisition channel for a specific product can fatally slow your growth.

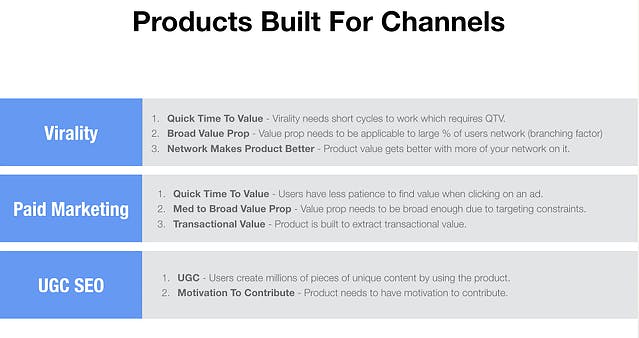

Brian explains how products are built on the backs of specific acquisition channels, so the rules of the game are defined by the channels. Products need specific attributes to succeed in specific acquisition channels.

For example, a viral growth channel works in short cycles for a very broad market. So for a product like Slack to succeed in growing virally, it needed to have a short time to value and a broad value proposition that's applicable to a large percentage of a specific user's network. On top of that, the product needs to be supported and improved by frequent and widespread use from the network.

Channel-product fit is always evolving—as new channels emerge, companies are born to create products that fit those channels. As channels die, the companies that served those channels die. Building your product for channel-product fit not only ensures you're current, it allows you to look ahead and take advantage of the next potential channel.

How You Can Make Sure Your Channels and Products Work Together

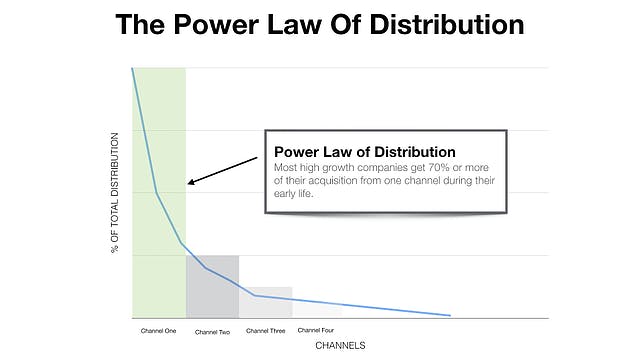

Brian argues against diversifying your acquisition channels. He explains that acquisition follows the Power Law of Distribution—meaning that most high-growth companies get 70-80% of their initial acquisition from one channel.

You can build a great company from successful distribution in just one channel. The “kitchen sink approach” doesn't work because by focusing on too many channels, you might never actually achieve good distribution in one—and that will kill your company.

Choose one acquisition channel that works for your market and build your product to succeed in that channel.

3. Rethink How Models Fit With Acquisition Channels

THINK: Build your model to support the right channel.

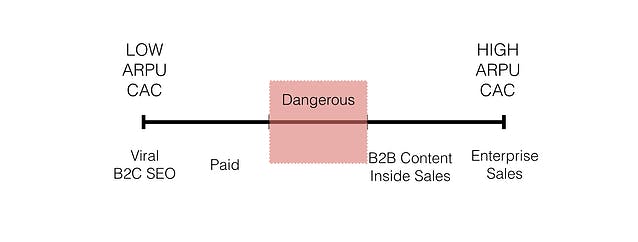

Business models that cater to high ARPU (Average revenue per user), high CAC (Customer Acquisition Cost) customers work very differently than those that cater to low ARPU, low CAC customers. You're not likely to capture these customers through the same acquisition channels, so you need to be strategic about which models you use with your channels.

For example, low ARPU, low CAC customers are acquired through viral channels and via B2C SEO optimization. The nature of these acquisition channels allows the customers they target to be low CAC, but at the same time it's also more likely that customers through these channels will be low ARPU.

Companies that use acquisition channels like B2B content and inside sales will acquire higher CAC customers that are likelier to have a higher ARPU.

Thinking of models and channels separately could lead you to develop a model that doesn't fit any acquisition channels and leaves you with very few potential customers.

Brian ran into this problem when he was building Sidekick, which at the time was a freemium sales product that was a division of HubSpot. While they already had a free tier and a $10 tier, they decided to create a $25 tier to capture higher-LTV customers.

This tier wasn't successful. They found that they couldn't acquire customers at a $25/month subscription rate through low-CAC channels, but at the same time the subscription rate wasn't enough to cover the cost of high-CAC acquisition channels on the right side of the spectrum. Bad channel-model fit began to stifle Sidekick's growth.

Brian's team solved this problem by getting rid of the $25 tier and creating a $50 tier. This higher-ARPU, higher-CAC model was a better fit with channels like B2B content and inside sales. They needed to create a model that supported a specific channel.

How You Can Create Models that Work With Particular Channels

Different plans in your pricing tier support different channel-model fits. To avoid falling into the kitchen-sink mentality, choose one model where you want to focus growth efforts—for instance, a lower-priced plan that targets low ARPU, low CAC customers.

Then direct your resources to an acquisition channel that supports that model—for instance, create paid advertising campaigns on social media channels that target this section of your market. Once you've found an acquisition strategy that supports growth for that model at that price point, shift your attention to focus on other points along your pricing scale, optimizing for growth in one model at a time.

4. Rethink How Your Models Fit Your Target Markets

THINK: Build your model to target the right market.

The type of model you use—the way that you target and deliver value to your ideal customers—will change depending on your target market.

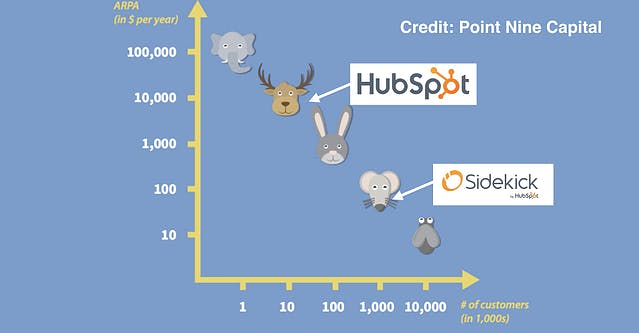

Brian cites this graph from Point Nine Capital to demonstrate how the number of customers you need to build a $100M line of business changes according to what type of customers you're targeting. The model you use to attract those customers changes according to your market.

When Brian attempted to build Sidekick as a $100M line of business with a freemium model, most of the customers were much lower in ARPU than the typical HubSpot customer. They needed many more customers to reach the $100M that was in the mission.

They wanted Sidekick customers to be HubSpot's typical, mid-market, mid-ARPU level customers. However, there weren't enough of those customers in the HubSpot market to meet the demands for a $100M line of business because they didn't have market-model fit.

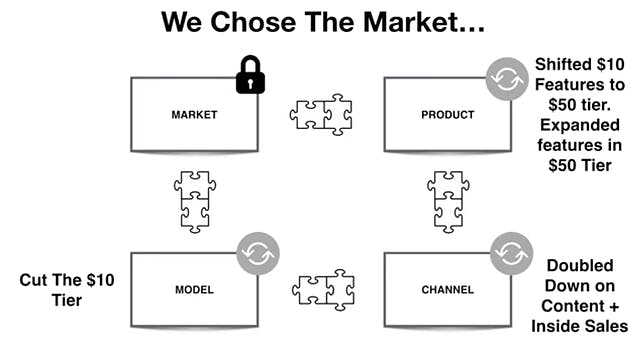

Brian's team chose to solve the market-model fit by keeping their target market—the core HubSpot users at mid-ARPU—and adjusting the model to target those customers. They cut Sidekick's $10 tier that was attracting more of the lower-ARPU customers and bolstered their $50 tier that better met the needs of their target market.

This change allowed them to grow from $0M-$10M ARR in 2 years.

How You Can Align Your Models and Your Market

Brian's team had to choose whether they wanted to keep their market or keep their model in light of their broken market-model fit.

Because they chose to keep their market, they had to adjust their entire ecosystem of growth components.

There's no correct order for determining market-model fit—you can choose to start with either component and build the other one to follow. It's most important that you recognize the relationship and build one to fit the other.

Recognize That The Fits of Growth Components Are Always Changing

You can't just focus on product-market fit if you want to build a $100M business. At some point, you'll stifle your own growth because your market, product, model, and channels are misaligned.

Consider these four components as part of a constantly evolving ecosystem. These four growth components have to fit together perfectly and respond to changes in the other components.

As one thing breaks, you need to evolve your business and shift the other three components so that they realign with the changed component.

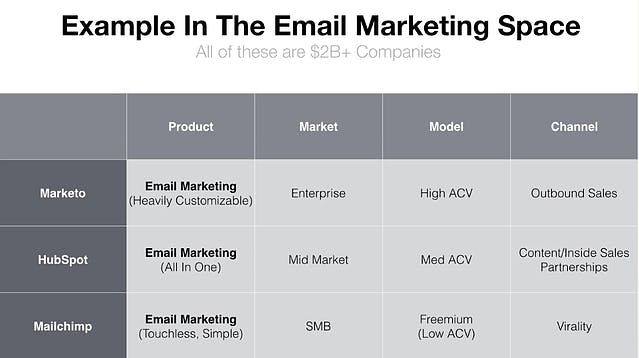

Aligning market, product, channel, and model for your specific company allows you to develop a successful niche even where other successful companies exist.

Three companies that provide email marketing automation—Marketo, HubSpot, and Mailchimp—have all built $2 billion businesses by aligning these four components. They've taken over different niches within the same competitive space and have evolved all of the other pieces of their business to support that niche distinction.

Evolving is now more important than ever in SaaS. The channels that most SaaS companies rely on today are breaking. As they become more saturated, new channels with emerge and growth components will need to shift. The future of SaaS belongs to the companies that can evolve all of their growth components along with these changes.

Brian is the Founder/CEO of Reforge which provides master classes for experienced growth professionals. He was previously VP Growth @ HubSpot and co-founder of two venture backed startups, Viximo and Boundless Learning. You can read more of his material on Coelevate.

Dive deeper into Brian's four-fits growth framework here.